“You don’t have to be rich to travel well.” – Eugene Fodor

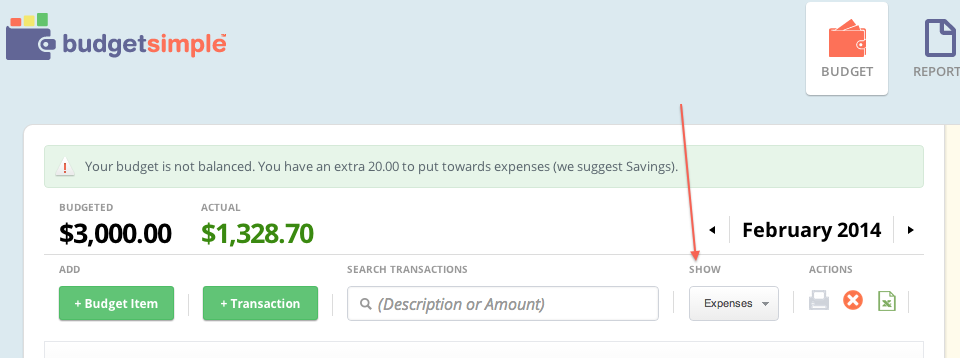

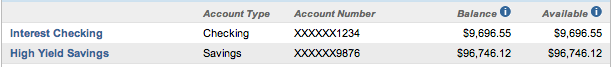

I love to travel, but luxury vacations aren’t exactly in my budget. I’ve found that the older I get, the harder it is to get away – in addition to finances, work commitments, household chores, errands and to-do lists bog down so many of my evenings and most of my weekends (not to mention the never-ending quest to catch up on sleep). I only see more responsibilities in my near future as I build both a home and a family, so I’ve made it a point to visit as many places and do as many things as I can now. So how can I afford to get away on a dime? I’ve found a few tricks and tips for pinching my pennies.