While not everyone celebrates the Easter holiday, many people are familiar with Lent, the forty-day observance before it (which started yesterday, March 5th). It’s during this time that many people choose to give up certain luxuries as a form of penitence. Even if you’re not a religious person, this can still be a great time for cleansing and renewal (a “Spring Cleaning,” if you will). Why not use it as a time to start fresh with your finances? Here are 4 ideas for things to “sacrifice” for the next month – choose one or choose a few! We’d love to hear any other suggestions you might have, too!

Destination: Anywhere

“You don’t have to be rich to travel well.” – Eugene Fodor

I love to travel, but luxury vacations aren’t exactly in my budget. I’ve found that the older I get, the harder it is to get away – in addition to finances, work commitments, household chores, errands and to-do lists bog down so many of my evenings and most of my weekends (not to mention the never-ending quest to catch up on sleep). I only see more responsibilities in my near future as I build both a home and a family, so I’ve made it a point to visit as many places and do as many things as I can now. So how can I afford to get away on a dime? I’ve found a few tricks and tips for pinching my pennies.

Penny Pincher

What you see isn’t always what you get, and sometimes that’s a good thing. I’m a firm believer that almost any price can be negotiated, and that you won’t know what you can get until you ask. The worst thing anyone can say to you is no, so give it a shot! I’ve found the most success negotiating costs for some of the things listed below. Happy haggling!

Creative Ways to Earn Decent Money Without Going Back to School

Something I hear too often that makes me cringe is “I haven’t been able to find a job doing X, so I’m going back to school (or going to grad school) for Y”. Going back to school is a super expensive proposition! Not only is there an opportunity cost (time used for money you could be making elsewhere) but the degree itself also costs a bunch. It’s unlikely in most cases that you’ll come out on top.

Have Your Cake and Eat It, Too

I’ve found that one of the most confusing things about saving money is figuring out what in the world you actually need to save for. Everyone pushes this idea that you need to have a back-up stash of cash in your possession in case anything unexpected should pop up – even as kids, most people have piggy banks to save up spare change for a rainy day. But what about things like life events (weddings, having a baby), large purchases (buying a house or car), or vacations?

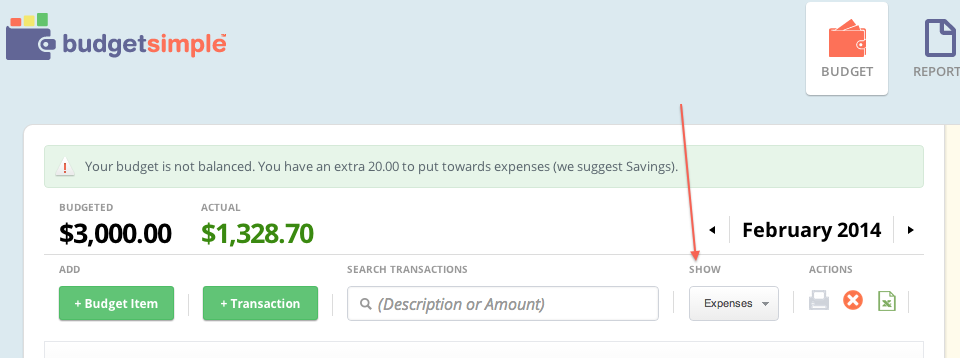

Feature Friday: The Views Of BudgetSimple

One of the features of BudgetSimple that can be confusing for new users is the different “views” we allow. These allow you to look at your budget in different ways. Today we’ll cover what you can see in these and how to change your views.

I Just Won A Thousand Dollars!

… well, at least that’s how I feel every time I see unallocated money in my bank account. Sometimes after I’ve paid all of my necessary bills, estimated what I’ll need for my variable expenses, and put some money aside in my savings account, I’ll still have some cash left, and it can feel a bit like hitting the lottery (a very small one, at that). So what do you do with that extra $25 or $50 you still have just hanging out in your checking account?

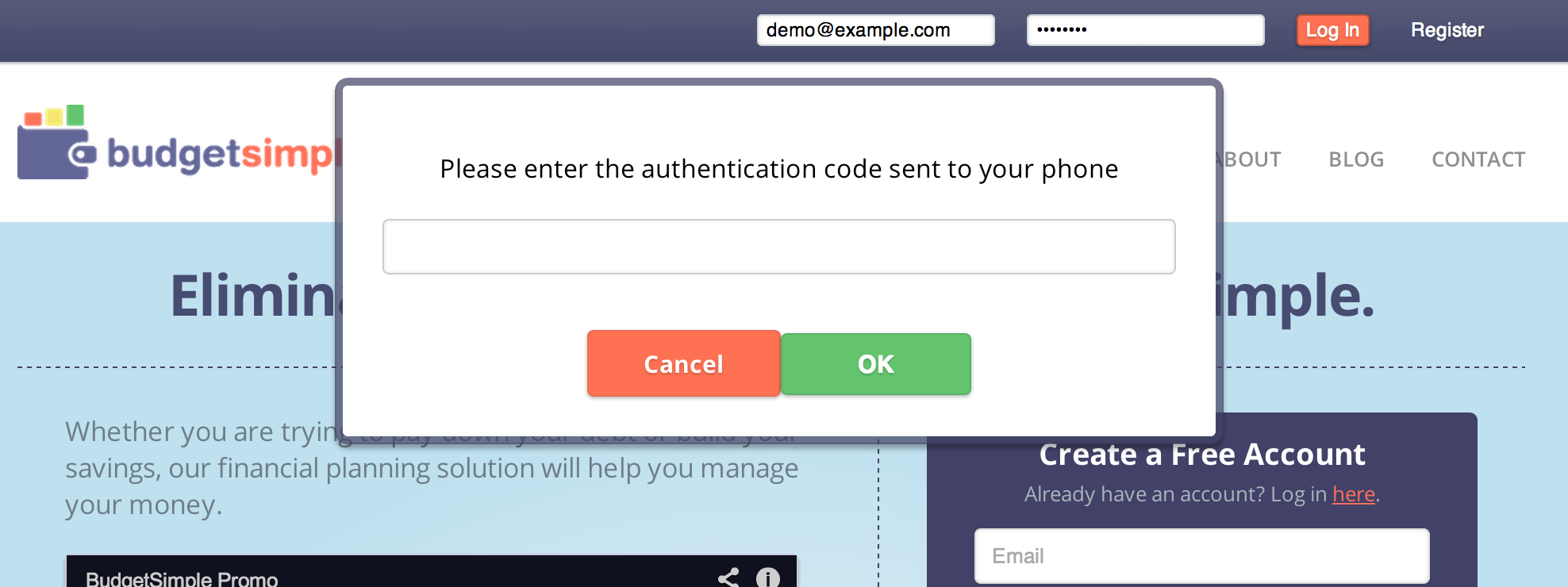

New Security Feature: Two Factor Authentication

I’ve mentioned it a few times, but it’s worth repeating again. Your data security is our number one priority here at BudgetSimple (customer service is number two in case you were curious). To that end, we’ve added another way to further protect your account today, two factor authentication.

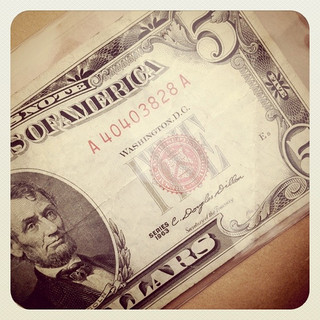

$5 Savings Challenge

One of the simplest ways to save money is to collect your spare change. It seems kind of trivial at first, small potatoes in the grand scheme of things, but it can add up quickly. I have fond memories of racing to my uncle’s couch in his “man cave” to search for loose change to add to my piggy bank (which I still do, 20 years later). Recently, I’ve seen a new idea pop up all over the internet that expedites the saving process a bit without sacrificing much: the $5 Savings Challenge.

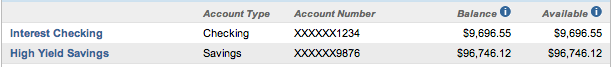

How Much Money is Too Much Money in Your Bank Account?

When I was 23, my biggest worry was that I wouldn’t have enough money in my Checking account. But once you start following the BudgetSimple Financial Game Plan you are going to have a different problem. TOO much money in your checking and savings account.