Phil and Andre talk about the options available for using your retirement for a down payment on a home.

Savings Tip – Evaluate Your Health Insurance Periodically

For this article, we’re going to assume you are lucky enough to have employer provided insurance (that you pay partially). Typically the way this works is when you start at a job you’re given a big packet of options, which you make a semi-informed decision about, and then leave out there while you go about your life. Now is a good time to evaluate your coverage and see if you can save money.

What’s The Deal With Tax Brackets?

Well it’s almost time for you to file your taxes, you did remember to do so right? Something I’ve found a lot of people have confusion around is the concept of tax brackets. Most people understand that tax brackets mean the more money you make, the more taxes you pay, since we have a progressive tax system.

We Make Money Easy Episode 14 – Student Loans

Phil and Andre talk about things to consider around Student Loans, and strategies for paying them off.

Stretching Your Dollars on Cleaning Products

Cleaning products are some of the most expensive things we keep around our house. A box of laundry detergent could easily be your most expensive purchase. For large families, these costs can really start to add up. So what’s the solution, let things get dirty?

We Make Money Easy Episode 13 – Things You Don’t Need

Phil and Andre talk about some things you may not need and could be wasting your money on.

We Make Money Easy Episode 12 – Peer to Peer Lending

Phil and Andre talk about peer to peer lending sites, such as Lending Club.

Money Markets, CDs and Savings, What’s the Difference?

Often people ask me where I put my savings, do I use a Savings account? What about CDs and Money Markets? What’s the difference between all of these anyhow?

We Make Money Easy Episode 11 – Credit Scores

Phil and Andre talk about what credit scores mean for you.

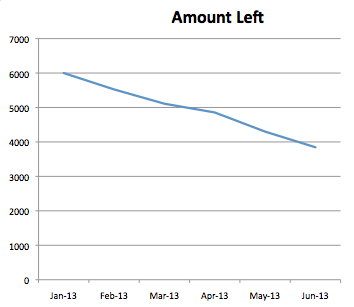

How to Make Budgeting a Habit

Almost every time I talk to someone about BudgetSimple, I get a similar reaction “Oh wow, I could definitely use that, I can never stick to a budget”. Sticking to a budget seems to be a pretty common thing. You start one often, but keeping to the plan more then a month or two is as difficult as sticking to a diet. I’m sure it’s different for everyone, but I wanted to share how I’ve stuck to a budget for the past ten years.