My husband and I just got back from our first road trip in our new car. One of the features it has that he was absolutely enthralled with is a gas mileage tracker, which monitors your usage as you drive, and then averages your trip out when you shut the car off. I’ve never paid much attention to it, but it inspired him to investigate how he could be more fuel-efficient in order to save more money (in addition to the fact that we were stuck in a car for nine hours). He shared a few tips with me that I’d like to pass along to you. Try them out and see if you notice a difference!

save

Savings Challenge Check-In

Remember when we challenged you to stick to a savings plan back in early April? Basically, we asked everyone to start by saving $1 during week one, and each week, you add one more dollar to that. Have you been keeping up with it? I have, and I wanted to take a moment to share my story with you!

8 Ways to Save On Your Summer Vacation

I’ve definitely been bitten by the travel bug, and summer is one of my favorite times to go and explore new places. We’re hoping to fit in as many trips as we can in the next year before we have bigger obstacles to tackle (see more about that here), but it’s not always cheap. So how am I fitting in a trip to Los Angeles, the Hamptons, our favorite spot in Maryland, Florida, AND the Caribbean Islands in just one year?

When to Buy What – Timing Hacks to Save Money

Did you know that if you plan your purchases according to what time of the year it is, you could likely get them for a better price? There are some common times throughout the year to find deals on any number of things, whether it’s seasonal or related to an event occurring during that month. Check out the list below to find some of the best times to save!

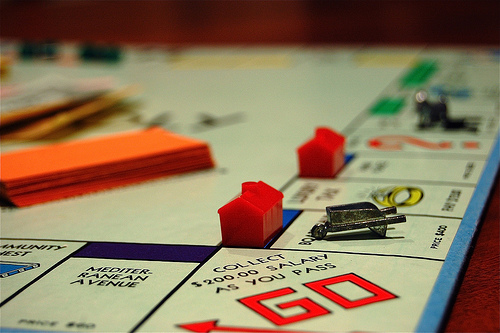

5 Mistakes to Avoid for Future Financial Success

Creating and sticking to a budget is the best way to set yourself up for financial success (and using BudgetSimple is a great way to get started). Sometimes financial decisions seem like a good idea in the here-and-now, but could impact you in a negative way later on. Avoid these 5 common mistakes people tend to make concerning their money and steer clear of future financial woes.

25 Ways to Skip on Spending

I remember being younger and always complaining to my mom that I had nothing to do. She always met my chorus of “I’m booorrrreedddd” with pretty unique ideas for things to do without much money, since I didn’t exactly have much of an income. Some of these things are still pretty relevant today (except now I complain to my husband instead of my mom). There are a ton of things to do without spending much, if any, money. Check out these 25 suggestions for free or nearly-free ways to entertain yourself! Some ideas are more fun than others, but all are easy on your budget.

Skills For Saving

So many of us lead busy, bustling lives nowadays, and it’s hard to find enough time in the day to finish all that we need to. Sometimes this can lead to extra “convenience” spending in order to have someone else take care of things that we could probably do on our own. Consider making more of an effort to try your hand at do-it-yourself projects.

Switch to Save – Doing Away With Disposables

We don’t think twice about throwing a number of different things out in the trash, but you would never throw away money, would you? While it might seem convenient to use disposables, you’re essentially doing just that when you toss them in the garbage. There are a ton of other reusable options that will not only save you money, but in most cases, they’re saving the environment, too!

Talking to Your Kids About Finances

We all know now that it’s important to budget your finances to plan for the future and manage expenses, but some of us don’t learn that lesson until later in life. We also all want the best for our children, so wouldn’t it be a great idea to teach them this while they’re young? Too many parents don’t discuss finances and how to handle money with their kids, and they send them off into the world unprepared and a bit naive when it comes to saving and managing their money. Start (and maintain) a conversation with your kids to help them understand how important it is to be money-savvy.